Accounting software designed by you and for you

Save time on your operations with a simplified process

Manage Your Accounting with Mobility Cloud:

Simplicity and Performance for SMEs and Small Businesses

Accounting is an essential pillar for any company, requiring precision and absolute traceability. With Mobility Cloud’s online accounting software, manage your finances remotely while benefiting from speed, fluidity, ergonomics, and connectivity. Specifically designed for SMEs and small businesses, our solution allows you to evaluate, analyze, and have a clear view of your financial and operational performance and situation of your company.

Some major features

-

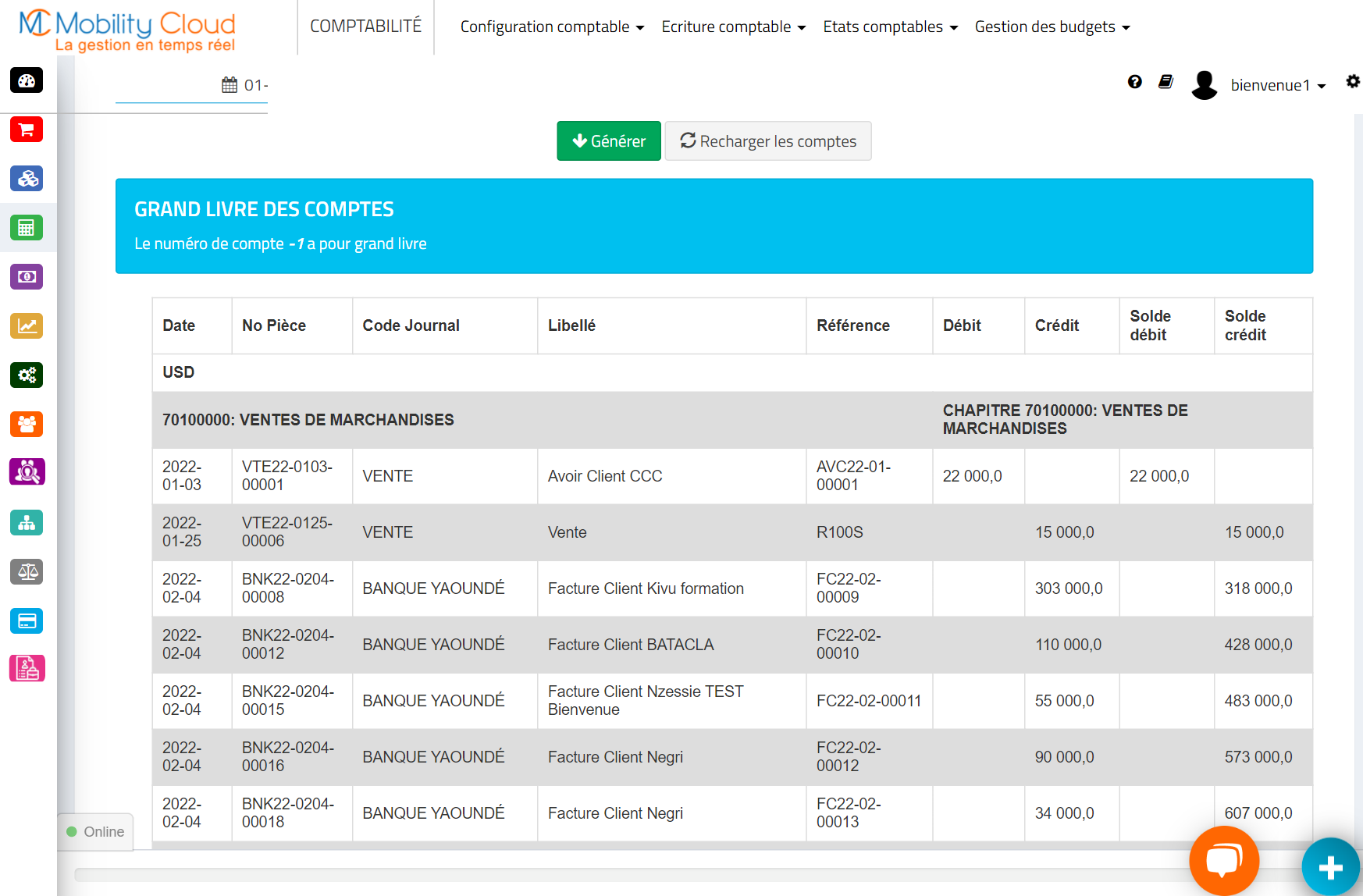

Account ledger

Comprising all company accounts listed in the journal, it allows account tracking. With the general ledger offered by Mobility Cloud, enjoy real-time visibility as soon as your transactions are completed, thanks to automatic synchronization.

-

Income statement

The income statement (IS) presents all revenues and expenses of a company during an accounting period. Like the balance sheet and the notes, it is part of the company's financial statements. It provides an overview and real-time visibility of the company’s revenue, allowing decision-makers to anticipate potential financial losses.

-

Accounting balance

It allows for the control of a company's accounting and ensures the accuracy of the balance sheet and the income statement. It includes all company accounts, showing credit and debit balances over the period. It provides absolute real-time visibility on all accounts related to the company, making tracking easier.

-

Budget management

Budget management is a plan or forecast of the presumed revenues and expenses a company will have to receive and incur over a given period. The objective is to steer the activity, anticipate risks, and make strategic decisions.

-

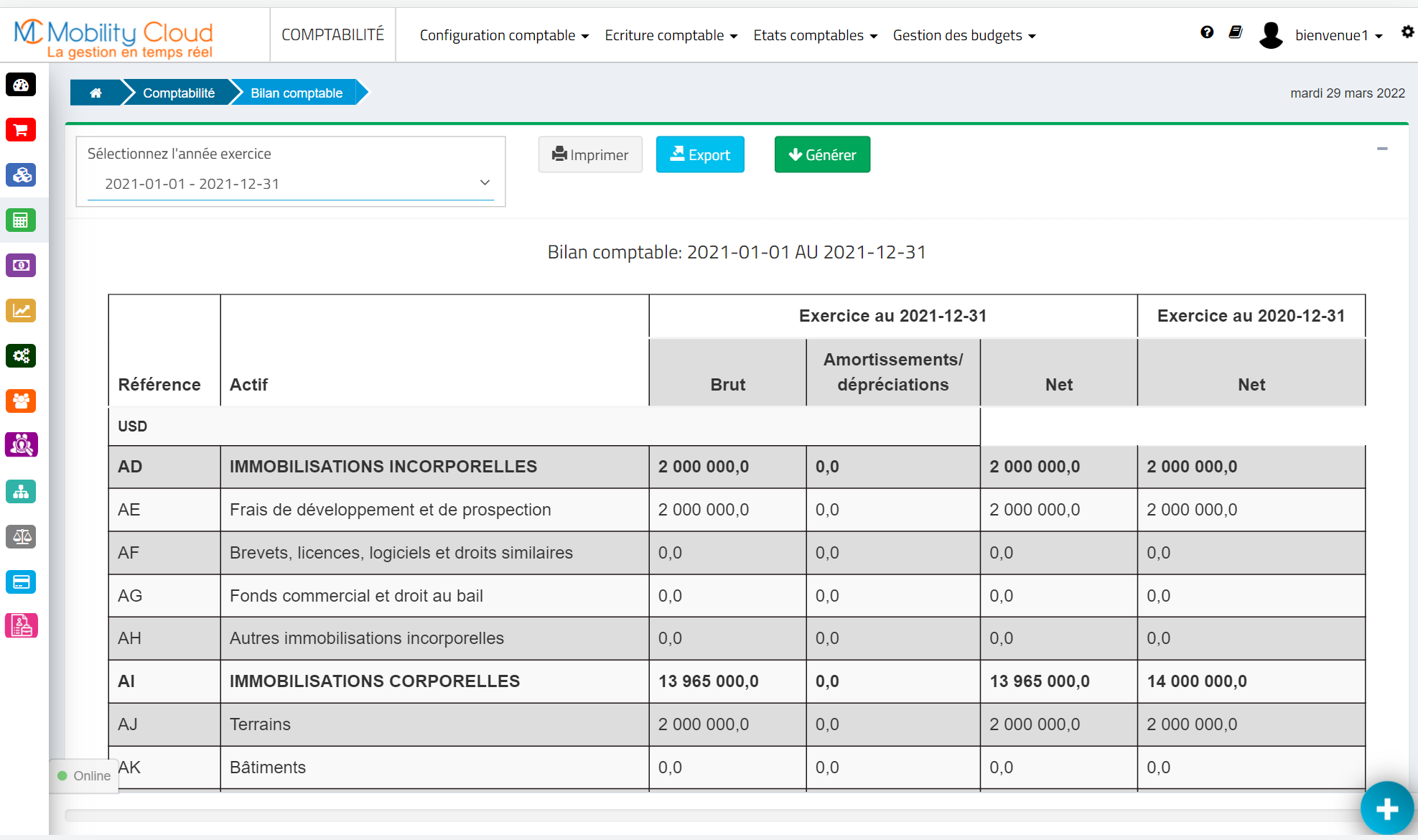

Balance sheet

A summary table presents the company's financial situation. Generally, it provides visibility on what the company owns (assets) and what it owes (liabilities), i.e., the resources used to finance its assets (loans, share capital…).

Thus, the balance sheet incorporates the company's financial statements, alongside elements such as the income statement and the notes.